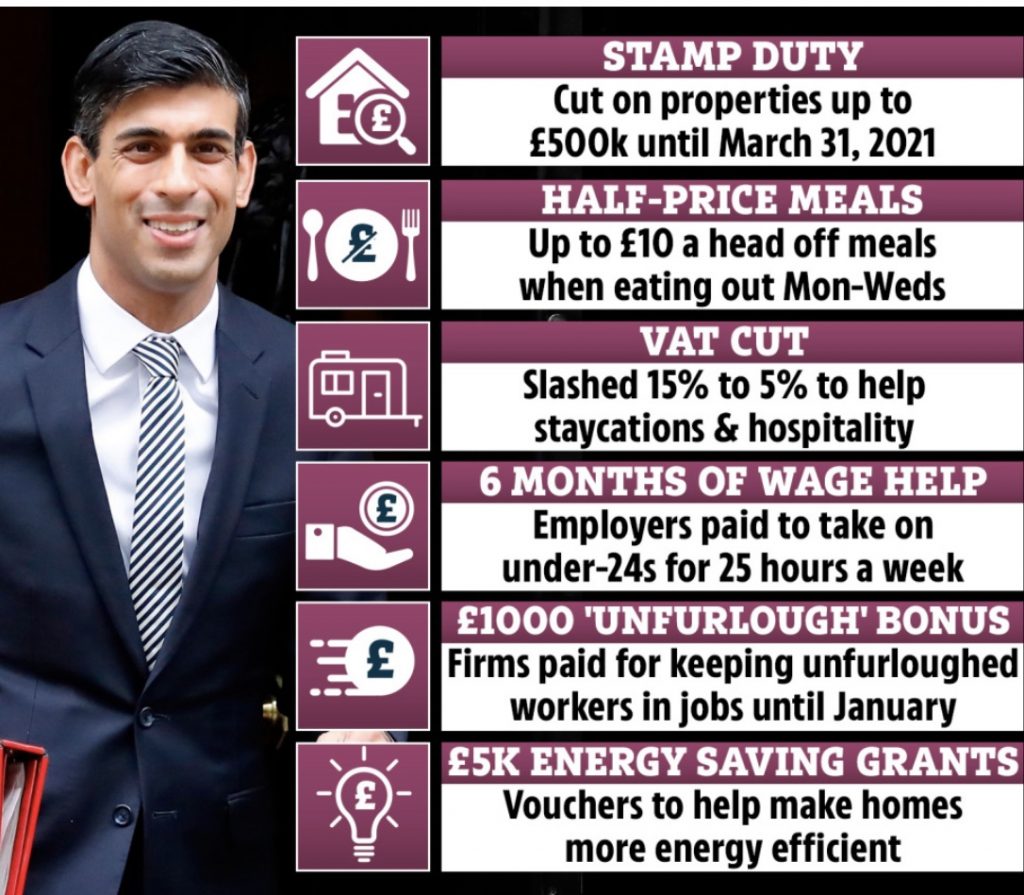

Rishi Sunak set out a mini budget yesterday, Weds 8th July 2020, with some more measures aimed at getting the economy running again. While we knew about a few of these, a couple were surprises, and I’m sure many were disappointed that the rumoured £500/£250 high street vouchers were not included!

So what do these new updates actually mean and how do they work?

Job Retention Scheme (aka Furlough!)

So we already know that flexible furlough started on the 1st July – you can read more about that in our flexi furlough blog here.

The Chancellor re-iterated that the scheme will close for good on 31st october 2020 – saying “We have to be honest. Leaving the furlough scheme open forever gives people false hope that it will always be possible to return to the jobs they had before”.

However he has announced a Job Retention Bonus. This will be a one off bonus paid to employers of £1,000 for each furloughed employee who is still employed as of 31st January 2021. Obviously there are a few conditions, which are:

-

The employee must earn above £520 per month on average for Nov/Dec/Jan

-

The employee was furloughed at any point during the scheme and included on a claim

-

The employee has been continuously employed up until at least 31st Jan 2021

Claims for this bonus can be submitted in February after the January RTI is submitted. We don’t have any further information on this as yet, but as soon as we do we will let you know! Full guidance is expected in the Autumn.

And while this is a great bonus and will help many employers and employees; unfortunately the reality is £1000 per employee will not go far for those businesses still not able to trade to full capacity and those with employees on higher earnings. It will not save all jobs, but it will help to save many, and will be a welcomed bonus.

VAT Rate Cut to 5% for Hospitality Businesses

From 15th July 2020 to 12th January 2021 VAT for any eat-in or hot takeaway food and drinks from restaurants, cafes and pubs, excluding alcohol. This VAT reduction also applies to all holiday accommodation in hotels, B&Bs, campsites and caravan sites, as well as attractions like cinemas, theme parks and zoos will be cut from 20% to 5%.

So this sounds good – but what does it actually mean?! Businesses providing these goods/services will only charge 5% VAT instead of 20% VAT. Meaning they should then pass these savings onto the buyer meaning a cheaper service to get people spending again.

If your business is VAT registered – then any purchases from these businesses double check your receipts to ensure you’re using the correct tax treatment in your accounts. The net purchase price will remain the same, just less VAT to pay and reclaim on your VAT return.

Those of you using Receipt Bank automation and Xero rules/defaults make sure you double check the VAT treatment and update any automations/rules/defaults accordingly.

If you’re the hospitality business selling these goods/services, you will need to adjust your pricing/invoices/tax rates to reflect the changes and ensure you are only charging 5% for qualifying goods and services.

If your business is not VAT registered (or you are purchasing personally) then you should notice these goods/services are a little cheaper!

Support for Jobs

Rishi Sunak also announced a few different measures to help create and support jobs for young people and apprentices.

The new Kickstart Scheme will fund jobs for young people aged between 16-24 who are claiming Universal Credit and are at risk of long-term unemployment. The employee will need to work a minimum of 25 hours per week , and the government will cover the wages (minimum wage) for 6 months. Employers can top this up if they wish. Employers can apply for the scheme from August 2020, and jobs are expected to be created from this Autumn. There doesn’t look to be a cap on the number of places available, which is great news.

Employers will also be paid £1,000 to take on trainees, with more funding also available for more leve 2 and 3 courses for young people.

And if that wasn’t enough there will also be an Apprentice Bonus where the government will pay employers £2,000 for each new apprentice they hire under the age of 25, and £1,500 for each apprentice they hire aged 25 and over, from 1st August 2020 to 31st January 2021.

Stamp Duty Cut

The threshold for paying stamp duty has been increased to £500,000 with immediate effect until 31st March 2021. So if you’re buying a new home (not a second home or buy to let) then if it’s under £500k you won’t pay a penny in stamp duty – yay! If your new home is over the £500k mark then the first £500k will be stamp duty free. This is a great way to get the house market moving again (anyone else heading to Rightmove to see what’s available?!), and I’m sure will help many people to get on, and move up, the property ladder.

Green Home Grants

From September 2020 home owners and landlords will be able to apply for grants of up to £5,000, with those in lower income households grants are available up to £10,000. These are available to fund improvements to your property to make it more energy efficient – which will also mean cheaper utilities! This is great for home owners and landlords – but also great for all the tradesmen out there that will benefit from the extra work (and talking of tradesmen – we have a few clients who may be able to help so if you need a recommendation please just shout).

Half Price Meals

I’ve saved possibly the best for last – the one I’m most excited about and I’m sure the majority of us will benefit from! It’s been called the Eat Out to Help Out discount scheme and will be running for the whole of August 2020. So basically the government want to encourage people to get back using cafes, pubs and restaurants. If you eat out at any participating business you will get 50% (up to £10 per person) off the bill – including the kids.

The discount can be used unlimited times Monday to Wednesday on any eat in meal (including non-alcoholic drinks) for the whole of August.

For eligible businesses wishing to sign up full guidance is expected today, with registration for the scheme opening Monday 13th July. Businesses will be able to claim weekly with the funds being paid to them within 5 working days.

So, it looks like Monday is the new Friday, and it’s time to go ensure your favourite place to eat is registering for the scheme! Would this tempt you to return to your favourite restaurants?

So overall, some great news all round, and I really do think this will help our economy and local businesses to start getting back on track, as well as introducing a little more normality into our lives. Let’s just hope the minority do not screw it up for the majority and we can all take a little bit of joy from these latest announcements.