This has got to be one of the most common questions we get asked.

Our fees are tailored to each individual, their business, and their needs. So there is no one price fits all solution. We have a minimum monthly fee of £99.99 plus VAT for sole traders and £250 plus VAT for limited companies, so this would be a starting point for the smallest of companies and minimal services.

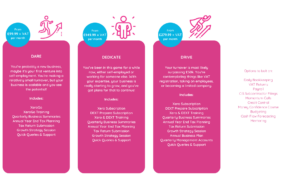

Below are some example packages of some typical businesses we work with, showing you how we’re able to help and a guide of the costs involved. Prices shown are minimum prices, based on the details shown. Prices are per month, based on a 12 month minimum term, in line with your financial year.

Sole Trader Pricing Examples

Limited Company Pricing Examples

As part of our prospective client process we will invite you in for a proposal meeting where we will go through all of our services, how they work and the value they bring to you and your business. Together we will then put together a package tailored to you and your business needs, and you will have a full proposal there and then in the meeting, detailing all the services we will be supplying to you, along with the associated fixed fees, as well as additional services that you may wish to consider for the future as your business grows and your needs change.

So how do we work out fees for our clients?

Our fees are based on the number of transactions, based on size of business, and the amount of work we complete each month/quarter. Some services will take into account your turnover. And we also take into account the quality of records – it’s not fair we charge same price for client whose records are complete and of good quality (completed by us or another bookkeeper) and for another client whose records are incomplete and incorrect and need working on before we can do anything! For this reason, it could be worth us doing the bookkeeping as in the long run it could keep the costs down – you don’t want to spend the time doing it yourself, then pay us to sort it out!

We pass the Xero subscription at cost in line with Xero’s RRPs. We charge Dext Prepare (Receipt Bank) at Dext’s minimum RRP, but as a flat rate, rather than increasing as the number of receipts increase as Dext do (a benefit of getting this through us rather than directly with Dext). Dext Prepare and Xero are a condition of us doing your Bookkeeping, VAT returns and Accounts – as this makes the process more efficient and will ensure the receipt is attached to each transaction for easy recollection. This will also help in the event of an inspection. This way of working is fully compliant with HMRC.

We pass the Xero subscription at cost in line with Xero’s RRPs. We charge Dext Prepare (Receipt Bank) at Dext’s minimum RRP, but as a flat rate, rather than increasing as the number of receipts increase as Dext do (a benefit of getting this through us rather than directly with Dext). Dext Prepare and Xero are a condition of us doing your Bookkeeping, VAT returns and Accounts – as this makes the process more efficient and will ensure the receipt is attached to each transaction for easy recollection. This will also help in the event of an inspection. This way of working is fully compliant with HMRC.

All fees are invoiced monthly in line with your financial year. If you join PPF part way through the year we will offer a one-off catch-up fee or spread over the remaining months for year so that your payments match your financial year. All fees will be payable by Direct Debit through GoCardless – this will help your cashflow (as well as ours!) and help you plan your money better – no large bills, you’ll have smaller bills each month instead. You can read more about why we insist on monthly direct debit in our blog!

We review software and payroll fees each month, bookkeeping fees each quarter and update your monthly invoices going forward as required. We will then review your accounts fees and VAT fees annually at a review meeting around 3 months prior to your year end.

Fees will increase and decrease as your business fluctuates in size and transactions. Obviously if you choose additional services then these will be charged in addition to your current services. If the software providers increase their fees, we may have to pass this cost on – but it will always be at providers increase – no extra mark up.

We are committed to giving our clients transparent and clear pricing and giving you value for your business every step of the way. We’re not the cheapest accountants, and that’s a good thing!

If you’re interested in working with us at PPF please visit our Work With Us page to complete the quick questionnaire, and at the end there is a link to book a 15 minute discovery call with us.